salt tax cap repeal 2021

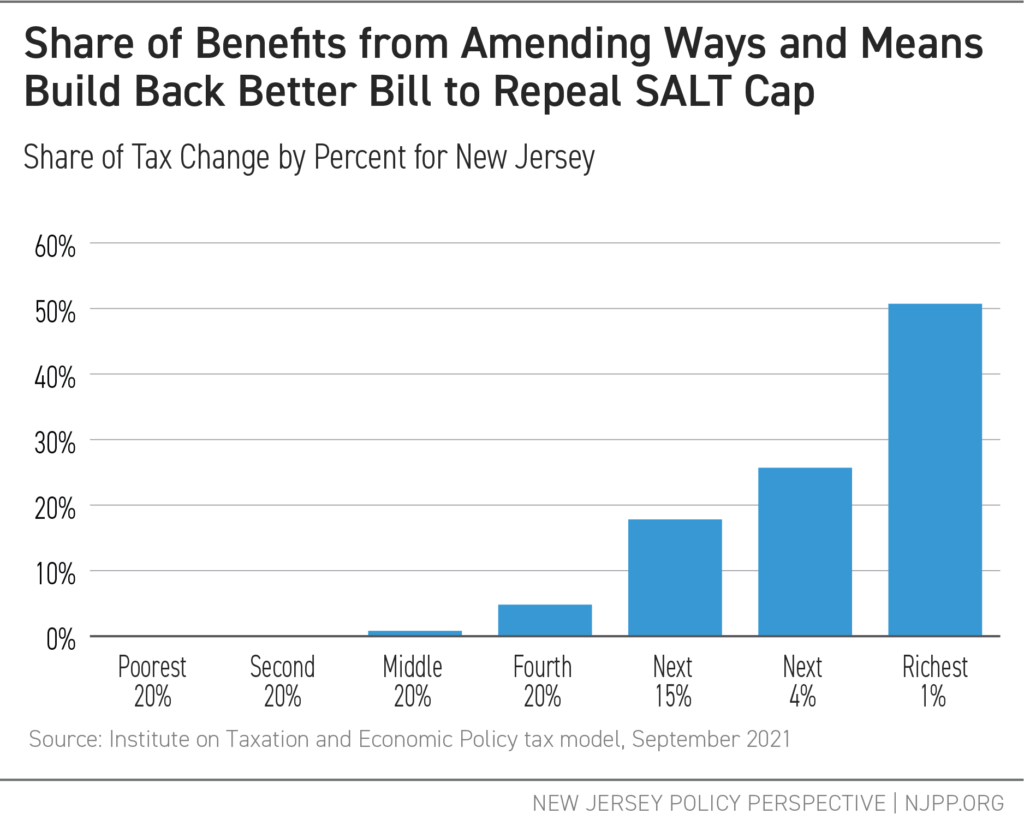

SALT-Cap Repeal Gains Momentum. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction.

Sanders Rips Pelosi Schumer For Backing Repeal Of Salt Cap

29 press conference the middle-class homeowners shared their stories of tax increases due to the 10000 SALT cap part of the Tax Cuts and Jobs Act TCJA of.

. September 13 2021 1044 AM. Various proposals are under discussion in Congress this week. Salt Tax Cap Repeal 2021.

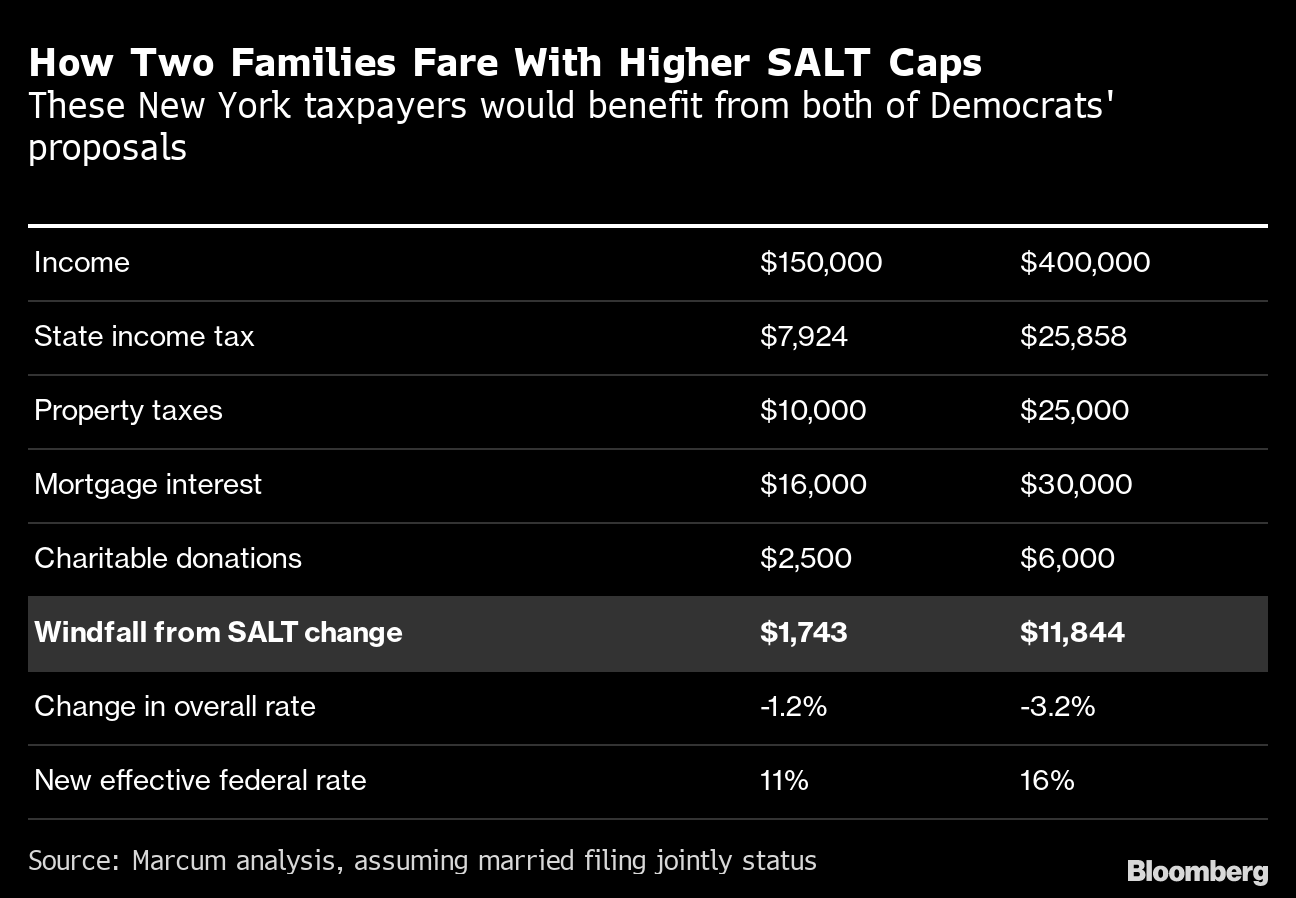

SALT cap repeal is no middle-class tax cut New York the top 1 percent would get a tax cut of about 103000 on. We examine how the repeal of the state and local taxes SALT cap in 2021 would affect federal revenue and the tax liabilities of taxpayers in each of the 50 states. Aggregate Tax Liabilities by Income Group Billions SALT Cap Repeal Compared to Current 2021 Law.

Last year Democrats proposed lifting the cap on the SALT deduction for 2020 and 2021 as part of a COVID-19 relief package arguing that it would provide relief to people hit. By Ana Radelat November 4 2021 900 am. In 2018 Booker would have been eligible for a 36026 SALT deduction based on the state and local taxes he paid yet because of the SALT cap he was only able to write off.

The Tax Policy Center found that only 3 of middle-income households would pay less in taxes if the SALT cap is nixed. Full repeal of the SALT cap is the worst option of all. Elrich says not so fast on SALT tax cap repeal.

All three options would primarily benefit higher-earning tax filers with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 28 percent. The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a.

By Laura Davison News April 15 2021 at 0253 PM Share Print. At the Oct. Salt Tax Cap Repeal 2021.

Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent. The cap on the SALT deduction. A host of moderate Democrats say they wont support President Joe Bidens 35 trillion package without a repeal of the cap on state and local tax deductions known as SALT.

Financial Planning Tax Planning. This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. SPECIAL REPORT TAX NOTES STATE VOLUME 102 OCTOBER 25 2021 405 Table 1.

The SALT limit deduction generated 774 billion during its first year according to the Joint Committee on Taxation and a full repeal for 2021 may cost as much as 887 billion. The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025.

House Bill To Temporarily Repeal Salt Deduction Cap To Get Floor Vote The Hill

New York Seeks Supreme Court Review Of Salt Cap

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

Why A 10 000 Tax Deduction Could Hold Up Trillions In Stimulus Funds The New York Times

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 1

Democrats Leave Salt Cap Repeal Out Of Initial Version Of Tax Plans

How A Change To The Salt Cap Would Affect Taxpayers By State Bond Buyer

Will Congress End Cap On State And Local Tax Deduction Deadline Looms

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

House Votes For Increase And Partial Repeal Of Salt Cap Knowing It S Going Nowhere Don T Mess With Taxes

Democrats Search For Sweet Spot On Salt Deduction Roll Call

Build Back Better Legislation Makes The Tax Code Fairer But Only If Salt Cap Stays In Place New Jersey Policy Perspective

Why This Tax Provision Puts Democrats In A Tough Place Time

House Democrats Push For Repeal Of Rule Blocking Salt Cap Workaround

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Salt Cap Repeal Democrat Tax Plan Will Benefit Top Earners In High Cost Areas Bloomberg