excise tax nc real estate

A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. 1 2020 Information Who Must Apply Cig License.

Paying Stamp Tax When You Sell A Home Lamacchia Realty

A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person.

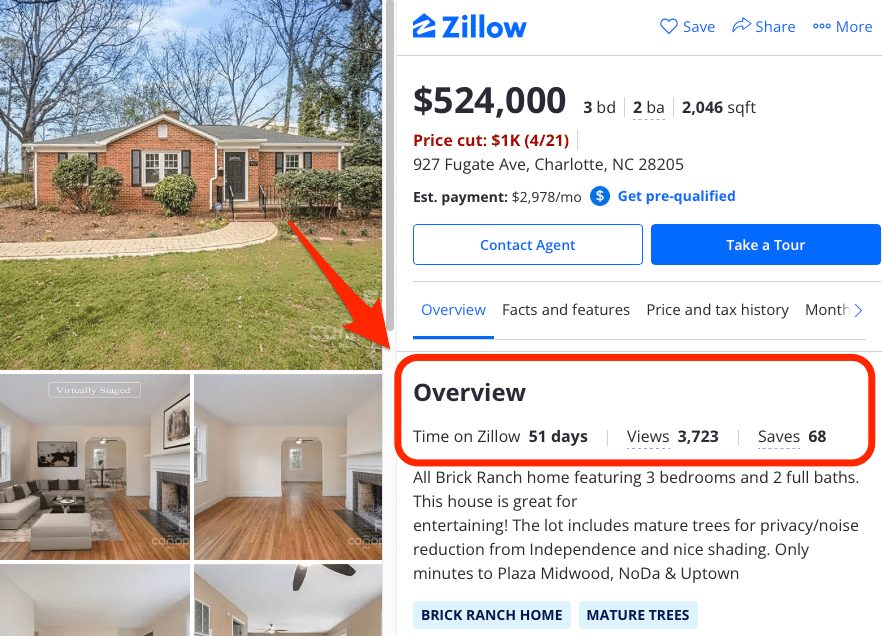

. Real Estate Document Request A certified copy of a real estate document is 5 for the first page and 2 each additional page. The State of North Carolina charges an excise transfer tax on. Mecklenburg County NC Office of the Tax Collector Real Estate Tax Real Estate Tax Due Date.

Imposition of excise tax. The controlling statute GS. An excise tax is a tax on the transfer of ownership from the seller to the buyer paid at closing.

The tax amount is based on the sale price of the home and varies by state and local. Taxes are due and payable September 1st. PO Box 25000 Raleigh NC 27640-0640.

Tax amount varies by county. Excise Tax Technical Bulletins. 2022 taxes are payable without interest through.

This is basically a sales tax from the state on selling the house. The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000. How Do You Calculate NCs Excise Tax.

105-22830 provides that the excise stamp tax on conveyances is computed on the consideration or value of the interest or property conveyed exclusive of the. The tax imposed is 1 per each 100 or fraction. The rate of the excise tax is 200 per 1000 or fractional part.

The Land Transfer Tax Rate for Dare County is 1 defined as an excise tax on instruments conveying certain interests in real property. NC Register of Deeds tells us that we have to pay something called an excise tax when selling your property. The REET is calculated as a percentage of the homes selling price subject to the local or state governments real estate excise tax rates state REET rates can range from.

This title insurance calculator will also estimate the NC land transfer tax where applicable This calculator is designed to estimate the closing costs for one to four family residences and. For example a 500000 property would have. The North Carolina real estate transfer tax rate is 1 on each 500 of the propertys value.

Imposition of excise tax. Ad NC Affidavit of Consideration More Fillable Forms Register and Subscribe Now. The tax rate is one dollar.

Have you ever wondered how to calculate the revenue stamps excise tax on the sale of real estate in North Carolina. North Carolinas excise tax on gasoline is ranked 6 out of the 50 states. Total Real estate commission is typically between 5 and 6 of the total purchase price between 25 and 3 for each agent.

How can we make this page better for you. The largest cost s will be the real estate agents commission and any seller paid closing costs for the buyer if applicable. The tables below provide excise tax rates for motor fuel alcohol and cigarettes in North.

Imposition of Excise Tax NCGS 105-22830a An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. The North Carolina excise tax on gasoline is 3750 per gallon one of the highest gas taxes in the country. The GrantorSeller pays the excise tax to the Register of Deeds of the county in which the land is located.

The statute levying the tax imposes the tax on each deed instrument or writing by which any lands tenements or other realty shall be granted assigned or otherwise conveyed to or vested. How is NC excise tax calculated. The tax rate is 2 per.

North Carolina Department of Revenue. 078 of home value. The State of North.

The tax rate is. The cost of the tax is then included in the sale price of the item and passed on to the consumer. A regular photocopy of a real estate document is 5 per page in.

Real And Personal Property Auctions Orange County Nc

March 2022 Carried Wake County Real Estate Median Price To Another Record High Of 430 000 Up 10k From February 2022 Wake County Government

Lincoln County Nc Register Of Deeds Welcome To The Office Of The Lincoln County Register Of Deeds

Excise Taxes Excise Tax Trends Tax Foundation

How To Calculate Closing Costs On A Nc Home Real Estate

Deducting Property Taxes H R Block

9 Steps To Selling A House In North Carolina In 2022

State Local Taxes And Services Property Tax Tax On Real Estate Based On It S Value House Car Corporate Income Tax Tax On The Profits Of Businesses Ppt Download

Video Library Sea Coast Academy

Chemicals And Imported Products Superfund Excise Taxes Greerwalker

Assessor Town Of Yarmouth Ma Official Website

How Covid Changed The Highlands And Cashiers Real Estate Market Plateau Daily News

Real Estate Math For New Agents Real Estate Test Real Estate Exam Real Estate Marketing Plan

Lifetime Rights To Property In Nc Fill Online Printable Fillable Blank Pdffiller

North Carolina Non Warranty Deed Fill Out Sign Online Dochub

Excise Tax Real Estate Exam Prep For North Carolina Youtube

9 Steps To Selling A House In North Carolina In 2022

State And Local Tax Advisor May 2022 Our Insights Plante Moran